Book Review | THE MYTH OF CAPITALISM4/28/2024

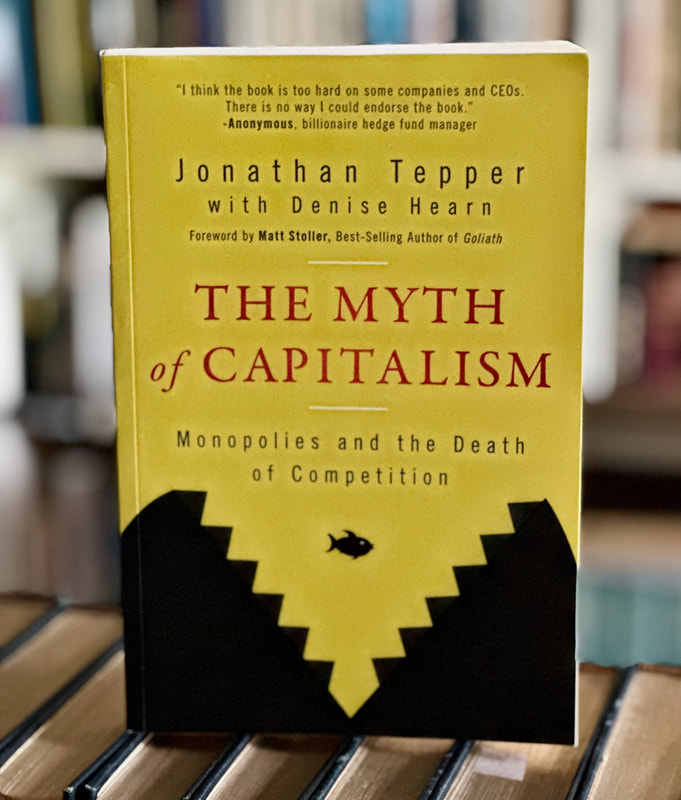

THE MYTH OF CAPITALISM | Jonathan Tepper, John Wiley & Sons (2023), 304p

Jonathan Tepper's ‘The Myth of Capitalism’ critiques modern economic systems, challenging the free market principles traditionally championed by classical liberalism. Tepper argues against what he sees as a marketplace increasingly dominated by monopolies and oligopolies, which he believes stifle competition and innovation. While his observations are sharp and his concerns valid, his historical analysis is fraught with inaccuracies driven by an ideological bias. Tepper's central thesis—that capitalism, as currently practiced, often devolves into anti-competitive monopolies—merits discussion. However, his interpretation seems to conflate the outcomes of market processes with the influence of regulatory frameworks that disrupt them. The market is an effective information-processing mechanism that inherently corrects monopolistic tendencies through creative destruction unless impeded by regulatory capture or government intervention. Government empowerment of rent-seeking protections fuels the corruption of the markets he aptly describes. The author attributes the rise of monopolistic practices to deregulation policies implemented in the late 20th century. When genuinely applied, deregulation increases market entry and competition; it does not diminish them. It is not deregulation per se, but selective deregulation coupled with regulatory protections for established firms that contributes to the economic concentration Tepper criticizes. True free-market policies involve reducing barriers for all, not creating selective advantages for the few. While Tepper highlights valid concerns regarding the dominance of firms like Google and Facebook, it is crucial to differentiate between temporary monopolies driven by innovation and those entrenched by government privilege. A temporary monopoly earned through innovation differs in nature and effect from one cemented through lobbying for favorable regulations. The former is often dynamic and transient in a healthy, competitive market, where new entrants can displace incumbents with superior innovation or alternative solutions. Tepper's call for stricter antitrust enforcement and regulatory reforms aligns with a common approach to handling government-created economic failures. However, increasing government oversight concentrates power - rather than diffuses it - and produces the common outcome wrought of a fatal conceit as understood in the paradox of the knowledge problem. The focus should be on ensuring the market is free from undue, distorting influences that inhibit competition. Simplifying regulations to make market entry easier and reducing the ability of powerful entities to leverage government power for competitive advantage would be a lower-risk, better first step. Jonathan Tepper's ‘The Myth of Capitalism’ is a crucial catalyst for reevaluating fundamental economic freedom in our present context. Yet his lens is bent towards the collectivization of power rather than its dispersion. Nonetheless, his diagnosis of the government-enabled development of monopolies and their restrictive impact on the choice or control of the custom merits robust engagement. He is right. The current state schematic has allowed companies to concentrate power in a fashion that a free market would not - absent government distortions - allow. In our collective experience, the first part of “The Myth of Capitalism” can be added to every other work demonstrating that big is bad: Big government, Big Business, Big Tech, Big Education, and Big Unions. KEY QUOTES:

OUTLINE:

Comments are closed.

|

NEWSLETTER SIGNUP

Categories |

RSS Feed

RSS Feed